Wealth and Taxes

The United States economy is a massive, complex engine, but two of its most debated parts are simple concepts: wealth (what you own) and taxes (what you pay).

1. The Big Difference: Income vs. Wealth

To understand taxes, you first have to understand money. In the U.S. system, money is treated differently depending on how you get it.

Income (The "Flow"): This is money you earn from working. If you work at a coffee shop, your wages are income. It flows in regularly.

Wealth (The "Stock"): This is the value of everything you own minus what you owe. It includes cash, but also houses, cars, and most importantly, stocks and investments.

Think of it like a bathtub:

- Income is the water flowing from the faucet.

- Wealth is the water sitting in the tub.

The Tax Reality: The U.S. government mostly taxes the faucet (income), not the tub (wealth).

2. How the "Regular" Tax System Works

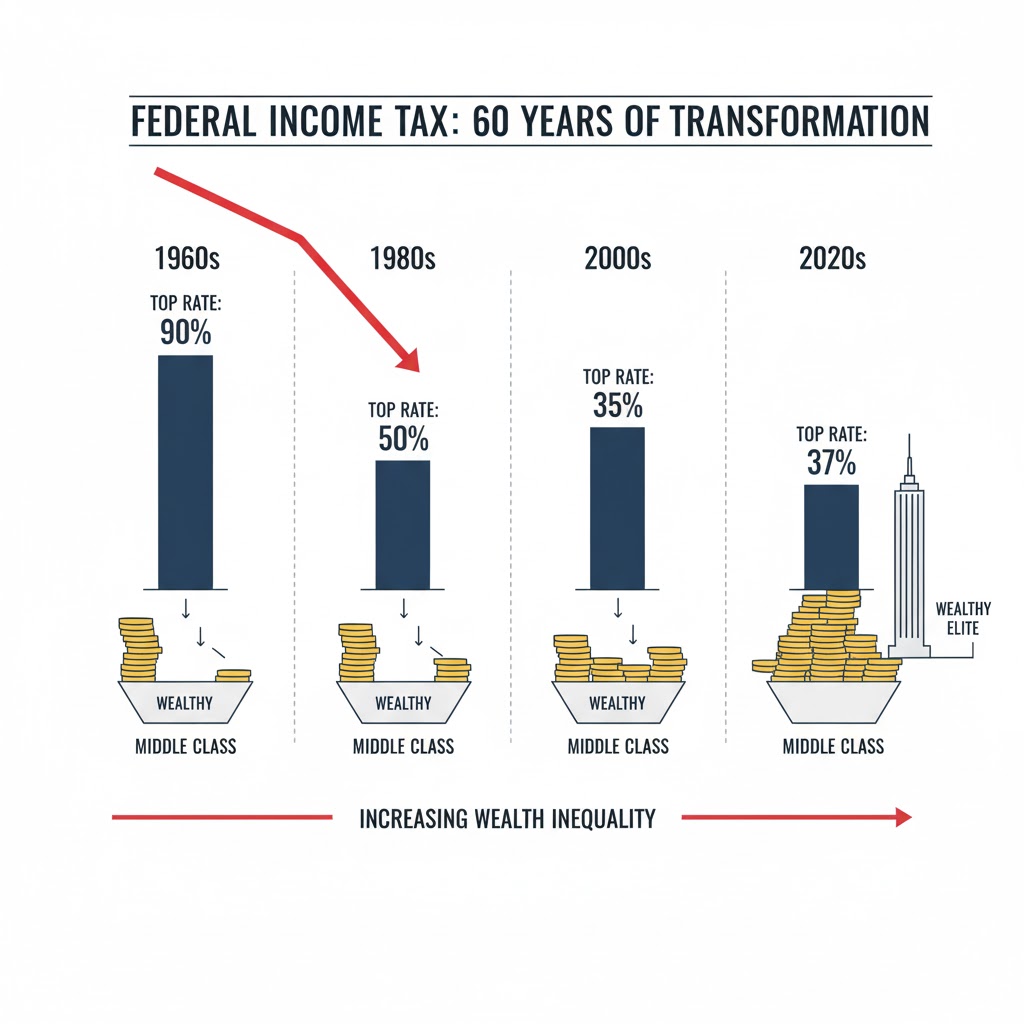

For 99% of Americans, taxes are based on a Progressive Income Tax system. This means the more you earn, the higher percentage you pay.

Tax Brackets: Your income is sliced into chunks.

- The first roughly $11,000 you earn might be taxed at 10%.

- The next chunk is taxed at 12%.

- If you become a doctor or engineer, your top earnings might be taxed at 32%, 35%, or even 37%.

Payroll Taxes: On top of income tax, everyone pays roughly 7.65% of their paycheck for Social Security and Medicare. This is a "flat" tax—it hits low earners just as hard (or harder) than high earners.

3. The "Billionaire" Loophole: Capital Gains

If the top tax rate is 37%, why do studies show some billionaires pay an effective rate closer to 8% or 20%?

The answer lies in Capital Gains.

Most super-wealthy people don't get rich from a paycheck. They get rich because they own assets (like stock in Amazon or Tesla) that go up in value.

Scenario A (You): You work hard and earn $100,000. You pay ordinary income tax (up to roughly 22-24%).

Scenario B (Investor): An investor buys stock for $100,000 and sells it for $200,000. They made $100,000 in profit.

The Twist: That profit is called a "Capital Gain." If they held the stock for more than a year, the government taxes it at a preferential rate: usually 15% or 20%.

The "Buffett Rule"

Legendary investor Warren Buffett famously noted that he pays a lower tax rate than his secretary. Why?

- Secretary: Pays high "wage" tax rates on every dollar earned.

- Buffett: Makes millions from investments, which are taxed at the lower "capital gains" rate.

4. Unrealized Gains: The Invisible Wealth

It gets crazier. You only pay capital gains tax when you sell.

If a tech CEO's stock portfolio goes up by $10 billion in one year, how much tax do they owe on that growth? $0.

Until they sell the stock, that growth is considered an "unrealized gain." It is "paper wealth." They can borrow money from banks using that stock as collateral to live a lavish lifestyle without ever actually "earning" income or triggering a tax bill.

Summary: The Wealth Gap

Because of these rules, the U.S. sees a massive concentration of wealth at the top.

- The Top 1% of Americans own roughly 30-32% of all wealth.

- The Bottom 50% of Americans own only about 2.5% of all wealth.

Conclusion

If the U.S. system of taxation were more steeply progressive instead of rewarding the wealthy, the huge disparity between the rich and all others would be reduced. As is, the U.S. tax system is designed to tax labor (working for a living) more heavily than capital (money making money). As you enter the workforce, understanding this distinction is the key to understanding economic inequality. The debate isn't just about how much tax people pay, but what is being taxed: the water in the faucet, or the water in the tub?

Comparison of Tax Rates

| Income Source | Typical Tax Rate (Approximate) | Who mostly pays this? |

|---|---|---|

| Wages / Salary | 10% - 37% (Progressive) | Most Workers |

| Long-Term Investments | 0%, 15%, or 20% | Wealthy Investors |

| Unrealized Growth | 0% (Until sold) | Ultra-Wealthy |